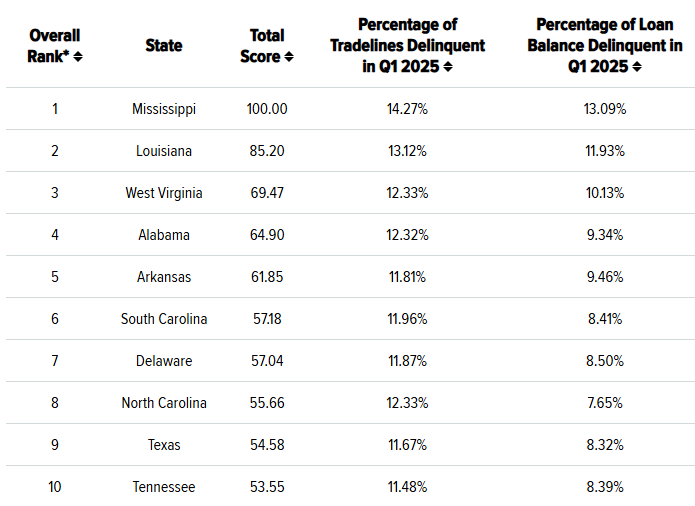

Which State Has The Highest Amount of Delinquent Debt

News Staff • August 10, 2025

Household debt has increased 13% since 2020 in the U.S.

You will often hear Alabamians say "Thank God for Mississippi" when it comes to a negative poll result. In a recent debt ranking by State Alabamians can thank Louisiana, Mississippi and some other neighbors. In recent data analysis by WalletHub, Alabama was shown to have 9.34% delinquent debt.

Adam McCann of WalletHub stated, On an individual level, delinquency might stem from forgetfulness or unexpected financial challenges. However, when a large share of people in a state are delinquent, it signals broader financial struggles among residents. To identify the places where people are facing the greatest difficulties managing debt, WalletHub analyzed proprietary user data from Q1 2025 across all 50 states. The ranking is based on both the percentage of individual tradelines that were delinquent and the share of residents’ total loan balances that were delinquent.

Mississippi has the biggest debt delinquency problem. Around 14.3% of individual loans and lines of credit in the state were delinquent in Q1 2025, the highest percentage in the country.

Mississippi doesn’t just lead the country in the percentage of delinquent accounts, though – it’s important to also look at the overall amount of debt that’s delinquent to get the full picture. When all the dollar amounts are added together, Mississippi residents are actually delinquent on nearly 13.1% of their overall debt. That is also the highest percentage in the country.

In Alabama the debt news is getting better. According to USA Facts, the average Alabamian owed about $47,100 in 2024. That was a $330 decrease from the prior year. While we may be on the list, residents appear to be paying down their debt.

Alabama still ranked in the Top 10 of the list. (See List Below)